Searching for a property, whether for personal use or investment purposes, is a significant undertaking that requires careful planning, research, and decision-making. This article provides an in-depth exploration of the property search process, covering essential steps, considerations, tools, and strategies to help prospective buyers and investors find the right property.

Understanding the Property Search Process

The property search process involves identifying, evaluating, and ultimately selecting a property that meets your needs, preferences, and financial capabilities. It encompasses several key stages:

- Define Your Requirements: Start by clearly defining your goals and requirements for the property. Consider factors such as location, type of property (e.g., residential, commercial), size, amenities, budget constraints, and desired features.

- Research and Market Analysis: Conduct thorough research on the local real estate market. Analyze property trends, pricing dynamics, neighborhood demographics, schools, transportation access, and future development plans that may impact property values.

- Financing Preparations: Assess your financial readiness and explore financing options. Obtain mortgage pre-approval to determine your budget and improve your negotiating position when making offers.

- Engage Real Estate Professionals: Work with experienced real estate agents or brokers who have local market knowledge and can provide guidance throughout the property search and transaction process.

Tools and Resources for Property Search

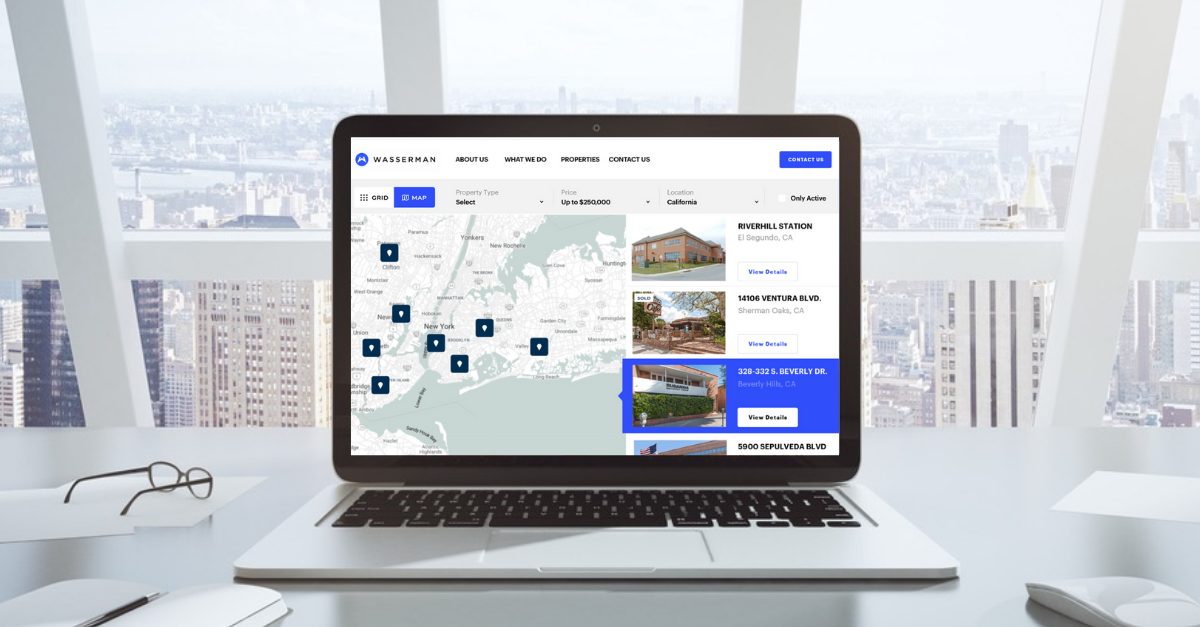

- Online Real Estate Portals: Websites and apps such as Zillow, Realtor.com, and Redfin offer comprehensive listings, property details, virtual tours, and neighborhood information.

- Local Real Estate Listings: Utilize local MLS (Multiple Listing Service) databases accessed through real estate agents for up-to-date listings and detailed property information.

- Social Media and Networking: Join real estate groups on social media platforms like Facebook or LinkedIn to network with agents, investors, and property owners who may have listings or off-market opportunities.

- Property Alerts and Notifications: Set up alerts and notifications on real estate platforms to receive updates on new listings, price changes, and market trends matching your criteria.

Factors to Consider During Property Search

- Location: Evaluate proximity to work, schools, amenities (grocery stores, parks, entertainment), safety, and neighborhood desirability, which significantly influence property value and lifestyle convenience.

- Property Type and Features: Determine whether you prefer a single-family home, condo, townhouse, or other types of properties. Consider factors like layout, number of bedrooms and bathrooms, outdoor space, parking availability, and additional amenities.

- Condition and Potential: Assess the property’s condition, age, maintenance history, and potential for renovation or improvement projects to align with your long-term goals and budget.

- Resale Value and Investment Potential: Analyze market trends, historical property values, and future growth projections to gauge the property’s potential appreciation and return on investment (ROI).

Conducting Property Visits and Inspections

- Schedule Property Tours: Visit shortlisted properties in person or virtually to assess their condition, layout, ambiance, and neighborhood surroundings.

- Home Inspections: Hire professional inspectors to evaluate the property’s structural integrity, systems (electrical, plumbing, HVAC), and identify any potential issues or repairs needed.

- Due Diligence: Review property disclosures, title reports, zoning regulations, and HOA (Homeowners Association) rules and fees to ensure transparency and mitigate risks associated with the purchase.

Making an Offer and Negotiating

- Market Analysis: Conduct comparative market analysis (CMA) to determine the property’s fair market value based on recent sales of similar properties in the area.

- Offer Preparation: Prepare a competitive offer outlining price, contingencies (such as financing and inspection), and desired terms. Consider seller motivations and market conditions when negotiating.

- Counteroffers and Acceptance: Navigate negotiations with the seller or their agent, responding to counteroffers, and reaching mutually agreeable terms before proceeding to the purchase contract.

Closing the Transaction

- Finalizing Financing: Secure final mortgage approval and ensure all financial arrangements are in place to fund the purchase.

- Legal Documentation: Review and sign the purchase agreement, disclosures, and closing documents prepared by legal professionals or escrow agents.

- Property Transfer and Possession: Coordinate the transfer of ownership, settle closing costs (including taxes, title insurance, and legal fees), and schedule the property’s physical transfer or possession date.

Future Trends in Property Search

- Technology Integration: Continued advancements in virtual reality (VR), artificial intelligence (AI), and big data analytics will enhance property search capabilities, offering immersive virtual tours, predictive analytics, and personalized recommendations.

- Sustainability and Energy Efficiency: Growing demand for eco-friendly homes with sustainable features, energy-efficient designs, and renewable energy solutions.

- Urbanization and Remote Work: Shifts in preferences towards urban amenities, suburban space, or rural retreats influenced by lifestyle changes, remote work trends, and mobility preferences.

- Regulatory Changes: Ongoing legislative developments affecting property taxes, zoning laws, and environmental regulations that may impact property values and investment decisions.

In conclusion, navigating the property search process requires thorough research, careful consideration of preferences and financial capabilities, and leveraging available tools and resources. By staying informed, proactive, and working closely with real estate professionals, prospective