Real estate for sale encompasses a wide spectrum of properties available on the market, each presenting unique opportunities and considerations for potential buyers and investors. This article provides an in-depth exploration of real estate for sale, covering its types, market dynamics, buying considerations, and future trends.

Types of Real Estate for Sale

Real estate for sale encompasses various property types catering to residential, commercial, and investment purposes:

- Residential Properties:

- Single-Family Homes: Detached houses designed for individual families, offering privacy and often including yards or gardens.

- Condominiums (Condos): Units within larger buildings or complexes, typically offering shared amenities like pools or fitness centers, and managed by homeowners’ associations (HOAs).

- Townhouses: Multi-level homes that share walls with neighboring units, combining aspects of single-family homes and condos.

- Apartments: Buildings with multiple rental units, offering opportunities for recurring rental income.

- Commercial Properties:

- Office Buildings: Spaces designed for businesses, ranging from small office suites to large corporate headquarters.

- Retail Spaces: Properties intended for retail stores, restaurants, shopping centers, and other commercial uses.

- Industrial Properties: Warehouses, manufacturing facilities, distribution centers, and industrial parks.

- Mixed-Use Developments: Properties combining residential, commercial, and retail elements in a single complex.

- Investment Properties:

- Rental Properties: Residential units or commercial spaces rented out for income generation.

- Vacation Homes: Properties used as second homes or rental properties in tourist destinations.

- Land: Undeveloped parcels of land intended for future development, agricultural use, or investment.

Market Dynamics in Real Estate for Sale

The real estate market operates within a framework influenced by economic, social, and regulatory factors:

- Supply and Demand: Fluctuations in property inventory levels, buyer demand, and market conditions impact pricing and availability.

- Economic Factors: Interest rates, employment levels, GDP growth, and consumer confidence influence affordability and investment decisions.

- Demographic Trends: Population shifts, household formations, and migration patterns affect housing demand and property values.

- Local Market Variations: Real estate markets vary by region, city, and neighborhood due to local economic drivers, amenities, schools, and infrastructure.

Considerations When Buying Real Estate for Sale

- Location: Evaluate proximity to workplaces, schools, amenities (such as grocery stores and parks), safety, and neighborhood desirability, as these factors significantly impact property values and lifestyle convenience.

- Property Condition: Assess the age, maintenance history, and potential renovation or repair costs to determine the overall investment value.

- Financial Readiness: Secure financing pre-approval, calculate affordability including property taxes, insurance, and maintenance expenses, and consider additional costs like closing fees.

- Legal and Regulatory Compliance: Understand zoning regulations, property taxes, environmental considerations, and HOA rules that may affect property use and ownership.

Tools and Resources for Real Estate Buyers

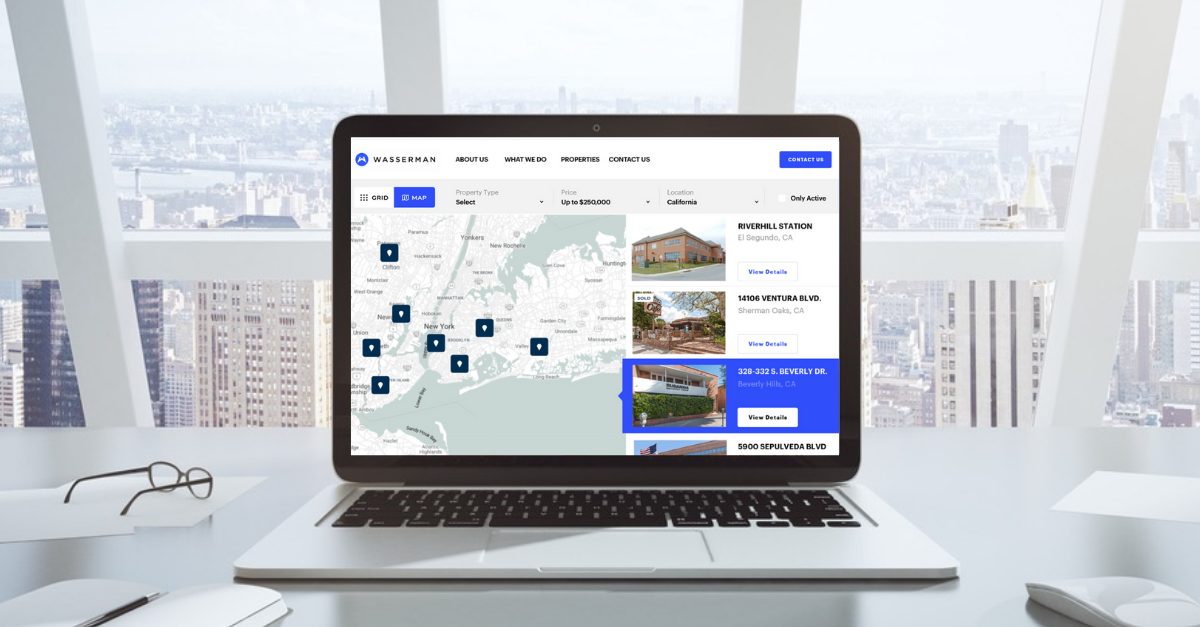

- Real Estate Listings: Access online platforms, MLS databases, and real estate agent networks to view current listings, property details, and market trends.

- Property Inspections: Hire professionals to conduct inspections for structural integrity, building systems, and potential issues before finalizing purchase agreements.

- Financial Advisors: Consult with mortgage lenders, financial advisors, and real estate professionals to explore financing options, tax implications, and investment strategies.

- Legal Counsel: Engage legal professionals specializing in real estate transactions to review contracts, negotiate terms, and ensure legal compliance throughout the buying process.

Future Trends in Real Estate for Sale

- Technology Integration: Continued advancements in virtual reality (VR), augmented reality (AR), and digital platforms enhance property searches, virtual tours, and transaction processes.

- Sustainability and Energy Efficiency: Increasing demand for eco-friendly buildings with green certifications, energy-efficient designs, and sustainable materials.

- Urbanization and Mixed-Use Developments: Growing popularity of mixed-use projects combining residential, commercial, and retail spaces to meet diverse community needs.

- Regulatory Changes: Evolving regulations addressing housing affordability, environmental sustainability, and smart city initiatives influencing real estate development and investment strategies.

Conclusion

Real estate for sale presents a wealth of opportunities for buyers and investors seeking residential, commercial, or investment properties. By understanding market dynamics, conducting thorough research, and leveraging available tools and resources, individuals can make informed decisions aligned with their goals and financial objectives. As the real estate landscape continues to evolve with technological advancements and regulatory changes, staying informed and adaptable is crucial for navigating the complexities of buying and investing in real estate effectively. Whether purchasing a home, investing in commercial property, or acquiring land for development, careful planning and strategic decision-making are essential in achieving success in today’s dynamic real estate market.